2018 is rapidly coming to an end and with it the proverbial question for any business owner “what can I do to reduce my taxes?” starts nagging away. Well, you might already be well aware of this particular tax feature but it’s worth bringing it up again.

Section 179 of the IRS tax code allows businesses to deduct the full purchase price of qualifying equipment and/or software purchased or financed during the tax year. That means that if you buy a piece of qualifying equipment, you can deduct the FULL purchase price from your gross income. It’s an incentive created by the U.S. government to encourage businesses to buy equipment and invest in themselves. Now, don’t take our word as the gospel—check with your accountant before going on a giant shopping spree!

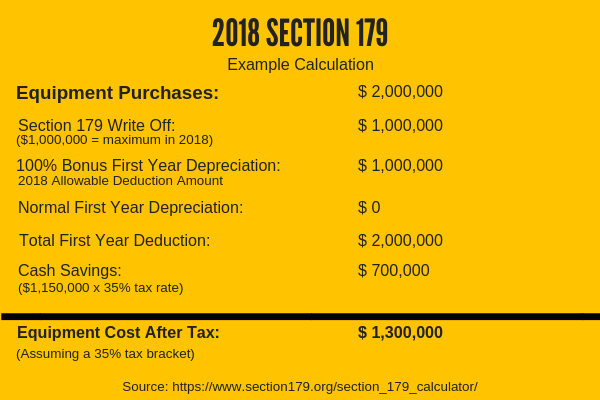

Section 179 at a Glance for 2018

- 2018 Deduction Limit = $1,000,000

- 2018 Spending Cap on Equipment Purchases = $2,500,000

- Bonus Depreciation is 100%

Check out this Section 179 example:

What equipment and vehicles qualify for a Section 179 tax deduction?

Vehicles and equipment can be new or used (“new to you” is the key). The vehicle must be acquired in an “arms-length” transaction, financed with certain qualified leases and loans, and titled in the company name (not in the company owner’s name).

- Most heavy construction equipment, including excavators, cranes, dozers, and loaders, qualify.

- Typical “over-the-road” Tractor Trailers will qualify.

- Vehicles that can seat nine-plus passengers behind the driver’s seat (i.e.: Hotel / Airport shuttle vans, etc.).

- Vehicles with: (1) a fully-enclosed driver’s compartment / cargo area, (2) no seating at all behind the driver’s seat, and (3) no body section protruding more than 30 inches ahead of the leading edge of the windshield. In other words, a classic cargo van.

How does Section 179 work?

In years past, when your business bought qualifying equipment, it typically wrote it off a little at a time through depreciation. In other words, if your company spends $50,000 on a machine, it gets to write off (say) $10,000 a year for five years (these numbers are only meant to give you an example).

Now, while it’s true that this is better than no write-off at all, most business owners would really prefer to write off the entire equipment purchase price for the year they buy it.

And that’s exactly what Section 179 does – it allows your business to write off the entire purchase price of qualifying equipment for the current tax year.

This has made a big difference for many companies (and the economy in general.) Businesses have used Section 179 to purchase needed equipment right now, instead of waiting. For most small businesses, the entire cost of qualifying equipment can be written-off on the 2018 tax return (up to $1,000,000).

Learn more about Section 179 here.

What’s on your shopping list?

If you’re looking for used heavy equipment, you’ve certainly come to the right place! Here at Eiffel Trading, we can outfit you for almost any type of heavy construction project. For example, check out these liquidation lists, loaded with equipment ideal for a bridge project or a road construction project.

Midwest Fleet Reduction

This list has 90+ items still available, including:

- Poseidon P2 Barges

- 2017 Tadano GR-350XL Crane

- 2016 BUMA Grab Bucket

- 2016 BUMA Casing Oscillator

- 2002 Manitowoc 999 Crane

- 2011 Inland Boat Works 2514

Midwest Liquidation

This list has lots of yellow iron, all suitable for bridge or road work, including:

- 2013 John Deere 850K Pipelayer

- 2005 CAT 312CL

- 2001 John Deere 410G

- 2013 APE D36-26 Hydraulic Impact Hammer

Send us a quick email at sales@eiffeltrading.com and we'll get the complete lists over to you.